Exploring Payment Solutions: Empowering QuickBooks Integrations with Flexible Payment Options and Revenue Opportunities

Case Study: Software Developer's Payments Integration Gives QuickBooks Customers More Payment Options & Monetizing Payments Volume

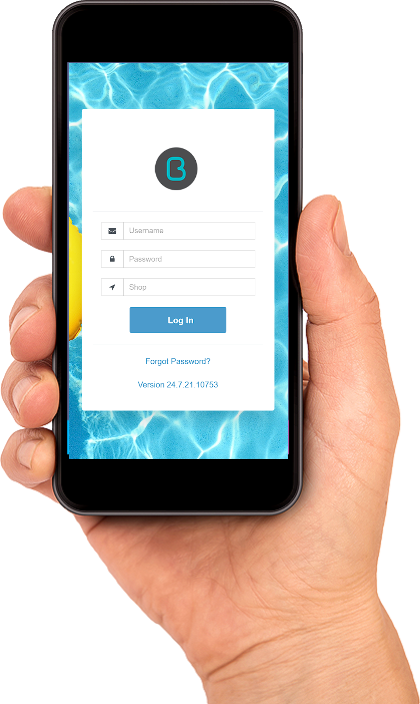

BufferZone, a software-as-a-service for pool shops and aquatic facilities, faced challenges with customers manually processing payments through QuickBooks, limiting their control over credit card rates and payment processors. To address this, BufferZone partnered with Paystri, a payment solution provider, to create an integration that allows shops to accept payments directly within BufferZone while still using QuickBooks for accounting. This collaboration offers benefits such as top-tier customer payment support, competitive credit card rates, secure transactions, and the ability for BufferZone to monetize payments, positioning BufferZone for future payment innovations.

Challenges

- Needed to separate payments from QuickBooks while still using QuickBooks for accounting

- Needed choice in payment processors across various geographic regions

- Desired the ability to monetize payments volume flowing through the BufferZone platform

Benefits

- Split payments and accounting from QuickBooks

- Introduction of P2PE Card-Present hardware enhancing processing security while lowering cost to process payments

- Card-brand compliant "Pass-The-Fee" functionality to eliminate credit card processing costs, supporting both Surcharge and Cash Discount giving pool shops ultimate flexibility in accepting payments

Issues

BufferZone is software-as-a-service created to help manage pool shops, pool service businesses and commercial aquatic facilities. The software contains powerful features such as customer management, communication and marketing tools, ordering, reporting, and more, and it offers integration with QuickBooks for accounting purposes.

Most customers were manually processing their payments using a separate existing point-of-sale system or, in the case of field service work such as cleaning and water treatment, were accepting checks or cash, or entering credit card numbers over the phone into QuickBooks.

By allowing QuickBooks to handle payments, shops had no control over their credit card rates, choice in payments processor, or the ability to offset credit card processing costs if they so chose. This is a problem many SaaS providers that integrate with QuickBooks face. BufferZone was happy to allow QuickBooks to manage data for accounting purposes, but the leadership team saw the payments component as an opportunity to help customers. BufferZone needed to find a better solution.

Solutions

Paystri, a strategic payment solution provider specializing in vertically oriented payment partnerships, teamed with BufferZone to create a solution to address BufferZone’s requirements. The goal was to allow BufferZone shops to continue to use Quickbooks for accounting, but provide flexibility and security when it came to collecting payments.

The fact that BufferZone is based in Australia and Paystri is based in the U.S. had no impact on the speed or efficiency of the integration. Paystri’s committed and creative team worked alongside BufferZone’s developers within the Australian time zone to quickly roll out a programmatically elegant payments integration that essentially pulled the sales/payments components away from QuickBooks and routed them through Paystri while still being reconciled and accounted for within QuickBooks.

As a result, BufferZone shops using Quickbooks can now accept payments within BufferZone through Paystri. These shops have better choices when it comes to payment processors, rates, fees, and more. Additionally, by integrating with Paystri, BufferZone has gained a forward-thinking payments partner who can provide insight into future payments innovations and ways to further monetize payments.

Outcomes

With one integration and partnership, the Paystri integration with BufferZone brings with it such benefits as:

- Choice beyond Quickbooks for payment processing

- Competitive credit card rates for card-present and card-not-present sales

- Card-brand compliant ability for shops to pass on credit card fees to customers offering both Cash Discount and Surcharge support, or to continue to absorb them themselves

- Enhanced security via P2PE encrypted payments hardware

- Being positioned for future payments innovation and monetization

Industry

Business Management Software - Pool

Company Size

488 Businesses Served / 1.5M Bodies of Water Managed

Results

Monetization of payments volume flowing through BufferZone software with enhanced customer payment support.